Time To Read: 4 Mins

Paytm Postpaid is a popular service to buy now and pay later. But recently it has been down and also suspended for many users. Moreover, it looks like the service can be discontinued soon. But if you’re looking for Paytm Postpaid Alternatives then let’s explore some of the Best Pay Later Apps available.

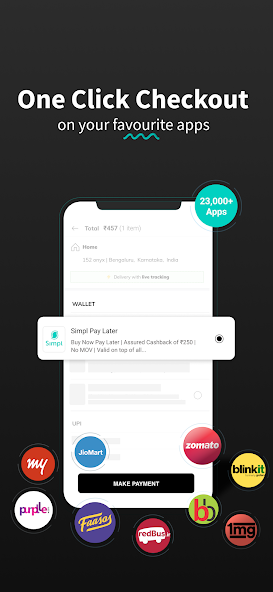

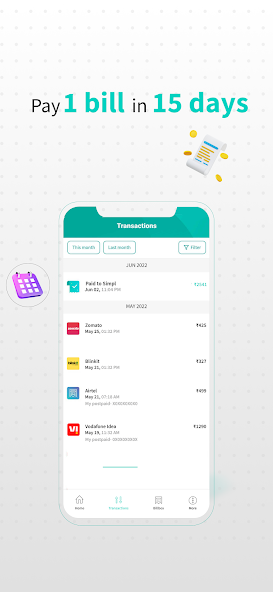

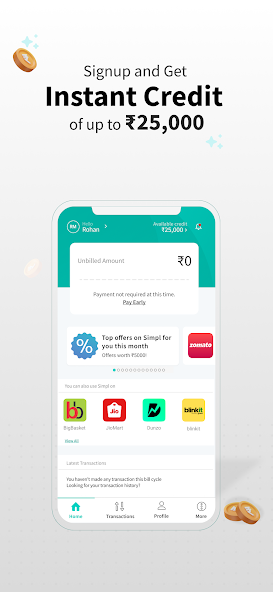

Simpl

This is a popular buy now pay later app with a credit limit of up to ₹25000. The app claims to be the smoothest payment app because of no OTPs and passwords during transactions. Also, to apply for the credit there’s a minimum digital KYC option which is convenient. Additionally, many brands like Zomato, BigBasket, Blinkit, Jio Mart, etc support the Simpl payment option. Apart from these, users can also make bill payments for gas, electricity, mobile recharges, water bills, etc.

Moreover, Simpl claims to charge zero interest on the repayment of the Pay Later bill. They generate the bill twice a month, on the 15th and at the end of the month. The transactions are recorded between these dates, also there’s a ₹250 penalty for any late payments. Initially, your credit limit will be limited like many other loan apps. However, it’s going to increase with every successful repayment of the loan. Simpl makes payments convenient, which makes it one of the best pay-later apps.

Make sure to read the terms and policy of the apps carefully to see if it suits your needs and then only take any loans.

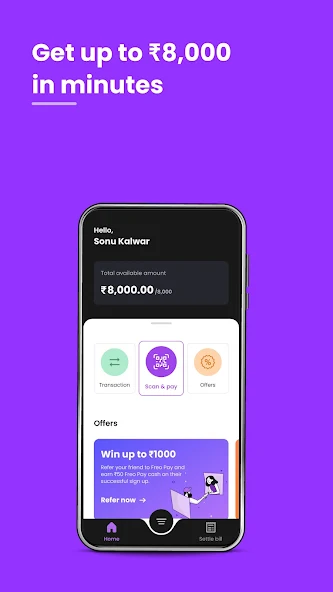

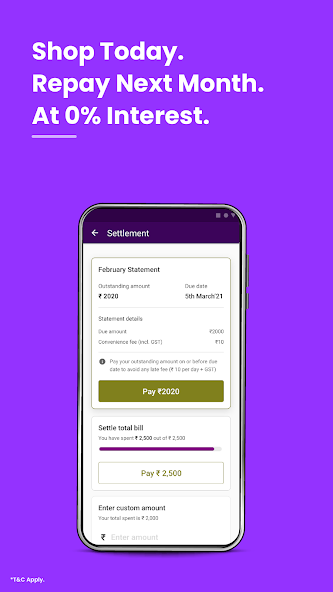

Freo Pay – Best Pay Later Apps

This is another popular Paytm Postpaid alternative and one of the best pay later apps. Freo Pay offers a credit of up to ₹10,000 for the buy now and pay later service. The app works with all major QR codes like Google Pay, PhonePe, Paytm, etc. Therefore, users can easily buy goods from local stores by scanning any QR codes. Also, the app works only for offline stores like your local Kirana, vegetable sellers, medicine shops, etc. So, no online apps like Zomato, Swiggy, Big Basket, etc will show Freo Pay as a payment option.

After downloading the app, users need to sign up and get approved. The app claims to have minimum paperwork and that it is also all digital. Also, the initial credit limit can vary from ₹500 to Max of ₹10,000 depending upon the user. Another advantage that the company claims is zero hidden charges for payments made. However, every repayment has a nominal convenience fee of 5% + GST. Also, we can repay the loan in 30 days which is a good enough time limit.

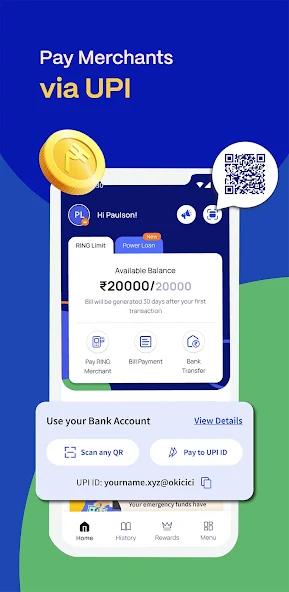

Ring

Ring is one of the best pay-later apps and a great Paytm Postpaid Alternative. They offer two types of limits one is a simple Ring credit up to ₹35,000. Another type is called Ring Power and it has a limit of up to ₹2,00,000. The company claims to have over 8 lakh Ring merchants where we can pay using the app. Another advantage is the ability to transfer the credit balance to our bank account. This feature is unique and the first of its kind.

Moreover, we can use Ring to pay via UPI ID or scan a UPI QR code. The app supports all major QR codes, so there’s no issue regarding that case. The company also claims to charge zero hidden fees for the repayment amount. We can also do transactions to both offline and online stores and services. Also, remember that for a Ring Power loan, there’s an interest rate of 18%-36% pa. Overall, Ring acts as a mix of a small pay-later credit as well as a normal loan credit app.

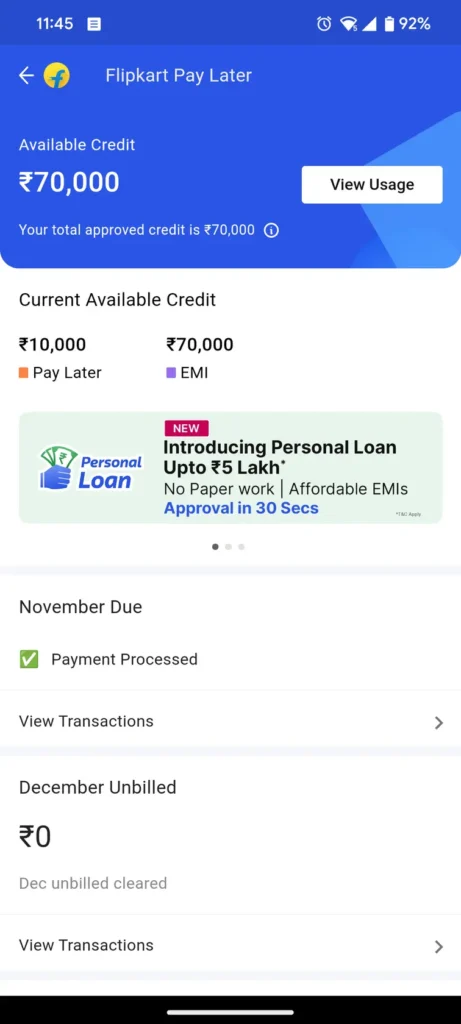

Flipkart Pay Later – Best Pay Later Apps?

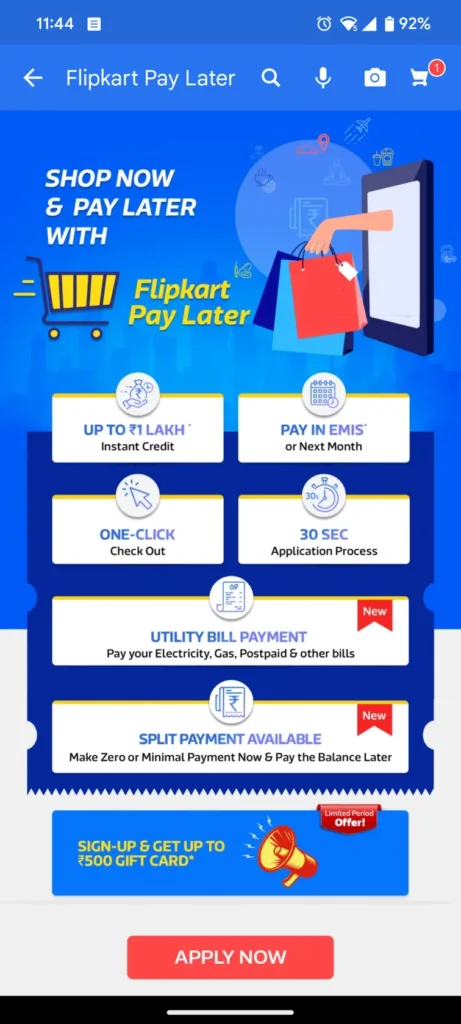

This is very similar to the concept of Paytm Postpaid but it’s restricted only to the Flipkart app. To obtain the Flipkart Pay Later membership, you can check my account page in the Flipkart app. Additionally, users can visit the link below from their phone and open the page in the app. The Credit limit is different depending on users and the upper limit is up to ₹1,00,000. However, only a certain amount is for the pay later and the rest is for the EMI.

Yes, apart from pay later, it can also be used for buying products on EMIs. Moreover, you can use it to pay for mobile recharges, bill payments and even groceries. For groceries, you need to use the Flipkart Grocery section, which features all the daily essentials. Additionally, we can buy mobiles, books, clothes, appliances, etc using the pay later option. Overall, Flipkart Pay Later is a good Paytm Postpaid alternative and among the best Pay Later apps.

DOWNLOAD (App) Flipkart Pay Later

RuPay Credit Card – Best Pay Later Apps Alternative

Now, this is a great new option for existing RuPay Credit card holders or you can freshly apply for the benefit. We now have the option to pay UPI ID and UPI QR codes with the RuPay Credit card. This is a great option for the buy now and pay later users as it eliminates the need for any third-party apps. Like the case with Paytm Postpaid, the sudden stoppage of the service has left users in a state of panic. But since Banks issue credit cards, there is a surety that comes with it.

Additionally, you can easily manage your credit card from the issuer bank’s app. We can repay the loan either the next month or also convert large purchases into simple EMIs. Of course, the credit limit will depend upon the user and can vary from ₹10,000 to ₹10 lakhs or more. Also, there’s a flexibility to pay anywhere, either offline or online. Also, you can enjoy all the benefits of the credit card like rewards and bonuses. RuPay Credit card is a great Paytm Postpaid alternative and one of the best pay-later apps. So if you can, try to apply and get approval as the approval process is subject to income source.

Verdict

Buy Now and Pay Later apps are great for those with no credit card. However, we need to make sure that we are careful while using these apps and do not get too dependent on them. In addition, make sure to repay the loan amount on time to maintain a healthy credit score. Moreover, the recent issue with Paytm Postpaid has created panic among the pay later users. Also with recent release of UPI payments with the RuPay card has opened up new ways to use your credit card. So stay aware and use the above apps mindfully.