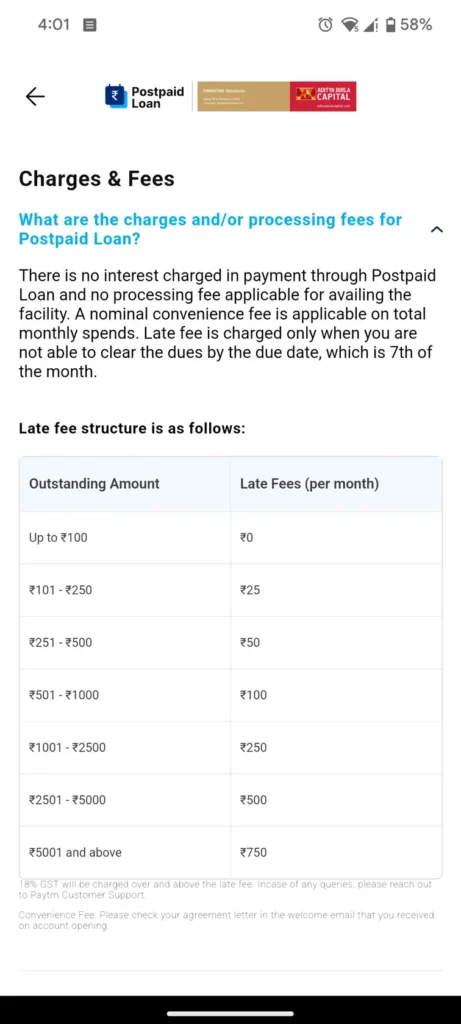

Paytm has temporarily suspended its buy-now-pay-later (BNPL) service, Postpaid Postpaid. The reasons could be due to increased caution from lending partners regarding fintech partnerships. The decision comes as the Reserve Bank of India raised the risk weightage for unsecured loans from 100% to 125%. Mandating NBFCs to allocate more buffer capital to cover associated risks. This move highlights the impact of regulatory changes on financial services. Additionally, it raises questions like when will BNPL services like Paytm Postpaid Start Working Again.

Paytm Postpaid Not Working

Users reported their accounts being suspended without explanation. Even screenshots of a chat with Paytm customer care revealed that the service was down with no information on when it would be restored. Many users expressed their frustration on social media, especially on X (formerly Twitter), tagging the official Paytm Care handle.

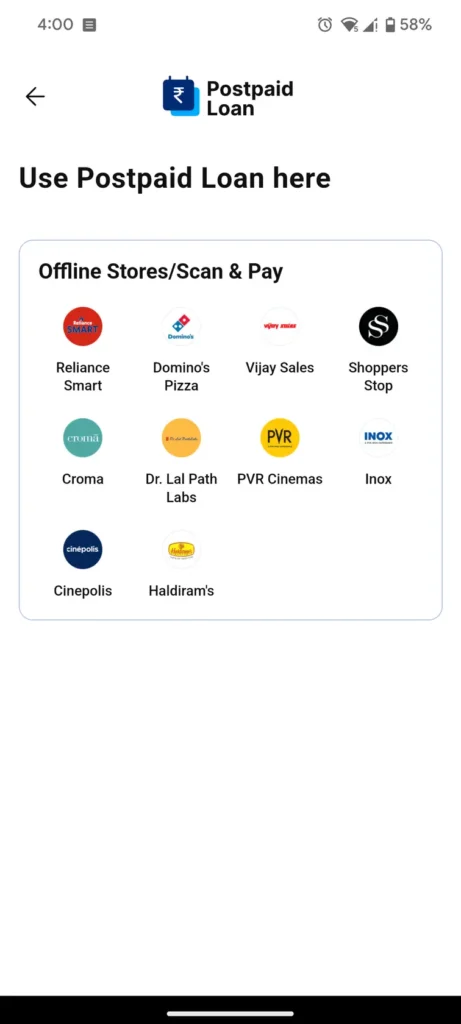

Paytm Postpaid, a service widely used for various payments such as rent, utility bills, and mobile recharges. Also, online purchases from platforms like Flipkart, Meesho, Zomato, and Swiggy, have abruptly stopped, causing significant concern and panic among users.

When will Paytm Postpaid Service Start Working?

According to sources, Paytm is making a big change in the case of Paytm Postpaid that will affect many users. Known for services like mobile recharges, bill payments, and personal loans through Paytm Postpaid, the platform is shifting its lending strategy. Instead of concentrating on smaller loans below Rs 50,000, Paytm is now focusing on providing larger personal and merchant loans. This change responds to evolving consumer needs, as a significant majority of loans through Paytm Postpaid were previously below Rs 50,000.

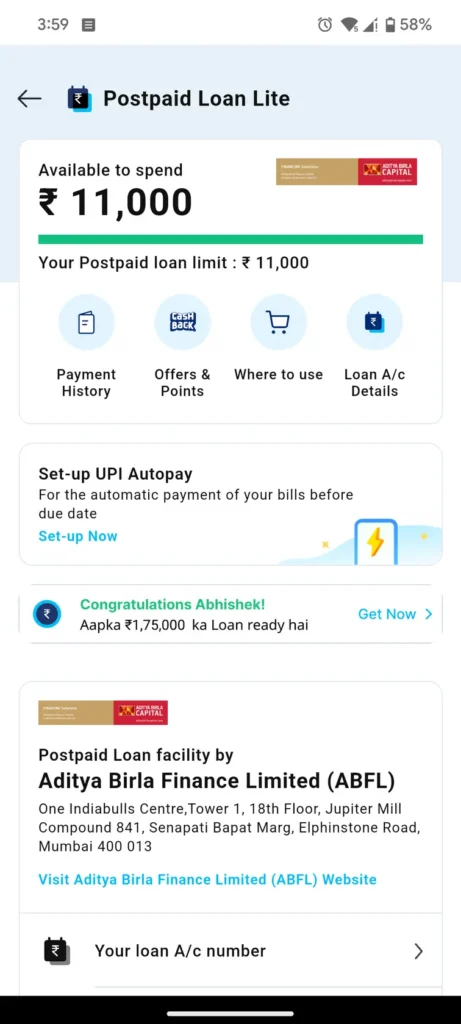

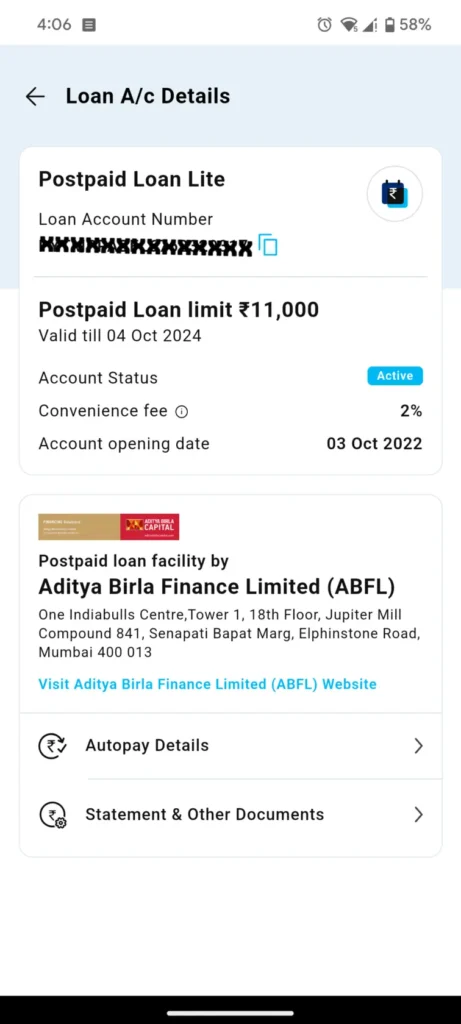

This isn’t just a minor adjustment; as they are restructuring the financial services according to the regulatory changes. Paytm, which had partnerships with financial entities like Hero Fincorp, Aditya Birla Capital, Piramal Finance, and Clix Capital, is now putting more emphasis on larger loan amounts. This shift signals a new era for Paytm’s lending priorities, potentially changing how users engage with the platform’s loan offerings.

Paytm Postpaid Fixes & Alternatives

Paytm is moving away from smaller loans and focusing more on significant financial assistance. This move marks a crucial moment in the platform’s evolution. Users can expect a different approach to accessing loans, as it will be mainly for major financial and personal needs. Users need to switch to other Buy Now Pay Later services for smaller loans. Read Best Pay Later Apps & Paytm Postpaid Alternatives 2023